Rental prices are not keeping up with home sale values.

Taking into consideration the current market and recent property tax increases in our area, it’s not hard to see that these two linked industries depend on each other more than people tend to realize.

When Landlords sell, they will sell at a market price. This has two potential consequences:

- If the buyer doesn’t rent, it reduces the supply of rental housing, thus increasing the rental price for other rentals.

- If the buyer rents the home out, they will have to base the rent on higher ownership costs, again resulting in a rent increase.

Since this data is changing daily, let’s look rental prices and home prices from reports in 2017.

The Seattle Times wrote an article on 12/5/17 entitled “Rent Control in Seattle? Bill to Repeal Statewide Ban in the Works.” From this article: “Rents have soared 65 percent since 2010 in Seattle — with the average two-bedroom now topping $2,000 a month.”

Whereas “Seattle’s Median Home price Hits Record: $700,000, double five years ago” (Seattle Times headline 4/6/17). Or, according to Zillow, Seattle’s Median home value has gone up 97% from Dec. 2010 to Dec. 2017.

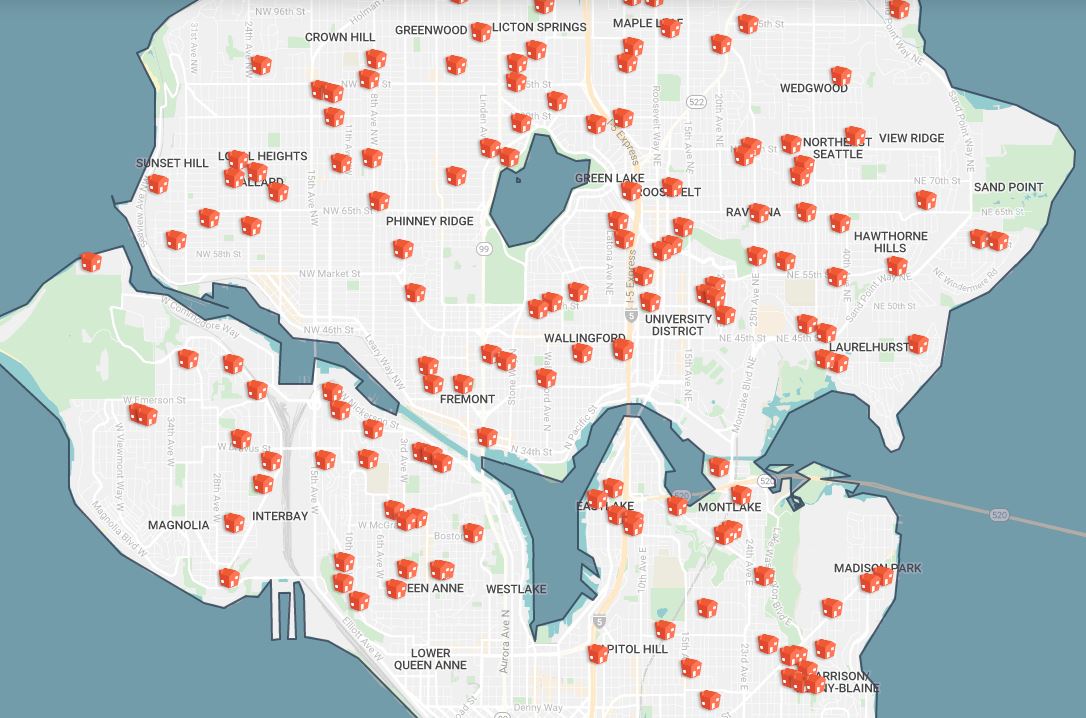

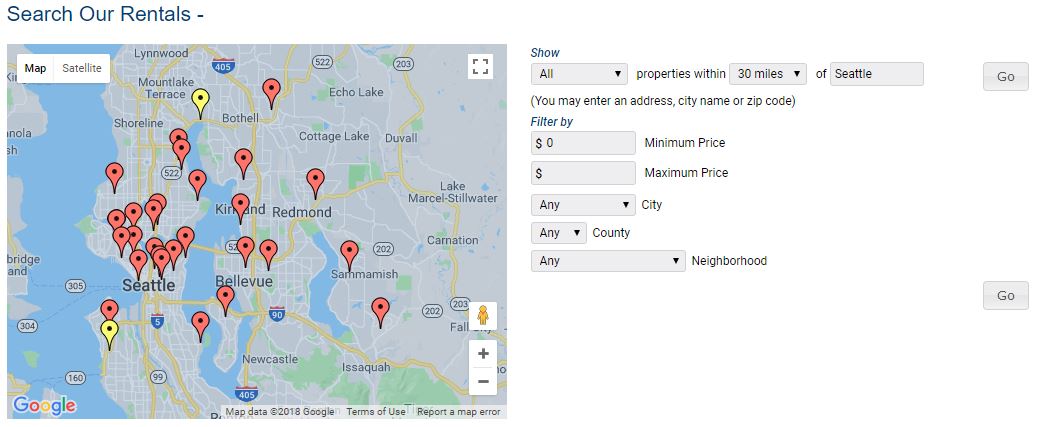

We see it all the time. Rental Prices are going up, tenants are struggling to find affordable housing, and people are struggling to buy their first homes.

To put this all into context, that increase in rental prices is 65% over 7 years, but home values have increased 97% in that same timeline.

So instead of ‘Rents have soared’, the more accurate message is: ‘Rents have failed to keep pace with surging property values and ownership costs’.

As we continue working in this industry, it’s important to remember that a sales and rentals coincide. When property investors buy or sell their investments, those prices ripple into the rental industry as prices go up for both the homeowner and the tenant.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link