More families than ever are renting instead of buying. Between 2006 and 2016, 1.9 million more families* in the U.S. were renting their home at the time of the census, a 16% increase in just 10 years.

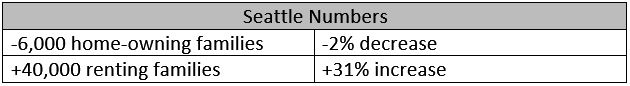

In that same 10-year time frame, Seattle saw 40,000 more households with minor children renting, and a decrease of 6,000 owning. That’s a 31% increase, but only a 2% decrease.

The barrier to entry into the sales market are the surging prices. Seattle’s single-family home prices, according to Rent Café, have increased 79% in the last 5 years, while rent prices have only increased by 45%. But, that 45% is the second highest change in rent price of 30 comparable metropolitan areas, and the home prices are ranked 3rd highest.

Not that we didn’t already know that rent prices weren’t keeping up with surging property values.

The pressure is on for the family-sized** rental market.

Yardi Matrix data shows that 52% of the new apartments built in the U.S. between 2006 and 2016 were family-sized. Meanwhile, only 30% in Seattle were more than 2-bedrooms. Of those 30 comparable metro areas, Seattle is ranked last in family-sized units built.

Seattle’s priority appears to be 1-bedroom units, which account for 53% of new apartments built.

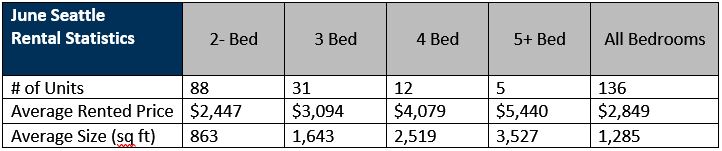

According to the Northwest MLS, the average rental in Seattle cost $2,849 in June.

A single parent would have to make $44.35 an hour to afford the average 2-bedroom unit without spending more than 30% on housing costs.

This article is inspired by the www.mynorthwest.com article about the decline of Seattle home-owning families.

*Rent Café defines a family with children as a household with minors in it.

**Rent Café defines family-sized homes to be 2-bedroom or larger.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link