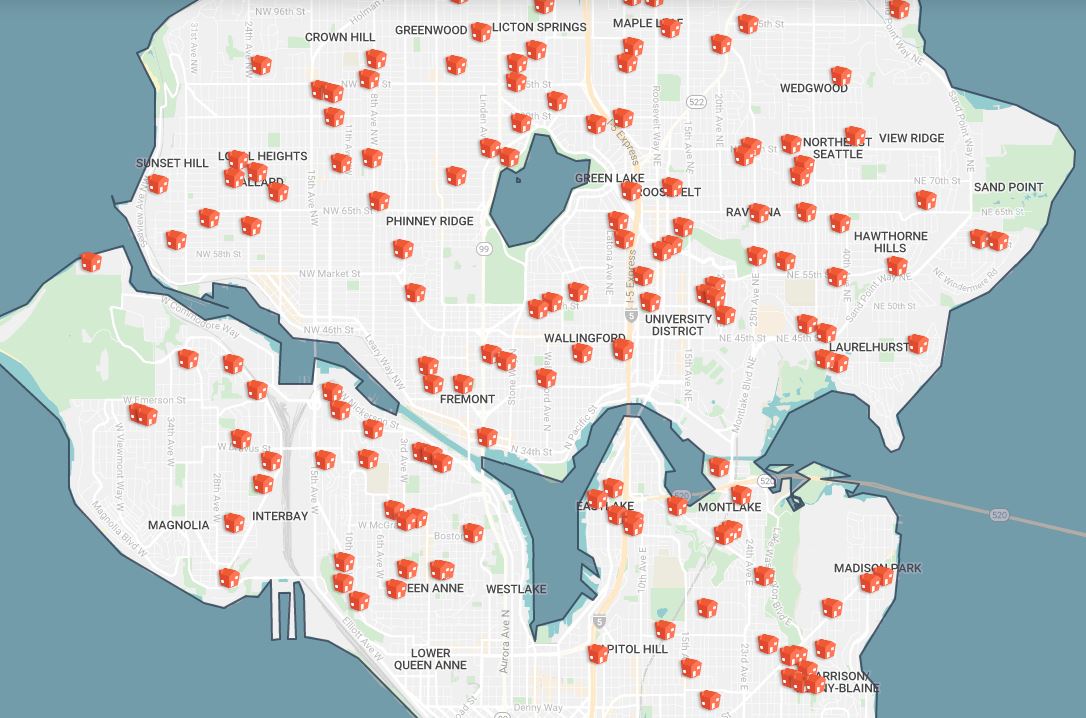

More Families Renting Rather than Buying

More families than ever are renting instead of buying. Between 2006 and 2016, 1.9 million more families* in the U.S. were renting their home at the time of the census, a 16% increase in just 10 years.

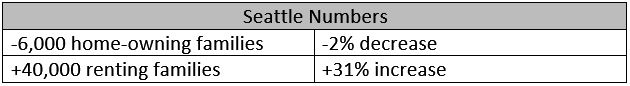

In that same 10-year time frame, Seattle saw 40,000 more households with minor children renting, and a decrease of 6,000 owning. That’s a 31% increase, but only a 2% decrease.

The barrier to entry into the sales market are the surging prices. Seattle’s single-family home prices, according to Rent Café, have increased 79% in the last 5 years, while rent prices have only increased by 45%. But, that 45% is the second highest change in rent price of 30 comparable metropolitan areas, and the home prices are ranked 3rd highest.

Not that we didn’t already know that rent prices weren’t keeping up with surging property values.

The pressure is on for the family-sized** rental market.

Yardi Matrix data shows that 52% of the new apartments built in the U.S. between 2006 and 2016 were family-sized. Meanwhile, only 30% in Seattle were more than 2-bedrooms. Of those 30 comparable metro areas, Seattle is ranked last in family-sized units built.

Seattle’s priority appears to be 1-bedroom units, which account for 53% of new apartments built.

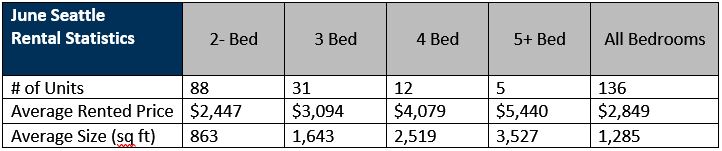

According to the Northwest MLS, the average rental in Seattle cost $2,849 in June.

A single parent would have to make $44.35 an hour to afford the average 2-bedroom unit without spending more than 30% on housing costs.

This article is inspired by the www.mynorthwest.com article about the decline of Seattle home-owning families.

*Rent Café defines a family with children as a household with minors in it.

**Rent Café defines family-sized homes to be 2-bedroom or larger.

Preparing to Rent a Home

Preparing to rent a home:

So, you’ve graduated, or you’re moving from your parent’s place for the first time. Here’s what you need to get in shape before you go apartment hunting:

-

Your credit score(s).

Use a free credit company to check your credit score. If it’s in the poor range, these sites often have tips to help you get it back up. Usually, this means paying off some of that credit card debt and setting up auto-payments so you’re never late on that monthly student loan payment.

-

Your budget.

Typical rental criteria requires that you earn 3x the rent. They normally use your pre-tax income, but it’s always smart to look at your income after taxes and use that as a guideline for what you can really afford. Just because a landlord will rent to you, doesn’t mean you should spend the maximum on rent.

Check to see if you qualify for any kind of government assistance, or for housing set aside as ‘low-income housing’.

Another option is a co-signer. Ask someone you know who trusts you to pay the rent but might have qualifications that make them more trustworthy to the landlord.

-

Your Expectations.

Use your budget to determine what kind of space you really need. Is a third of your income going to get you a one-bedroom, or a studio? What if you get roommates to go in on a house?

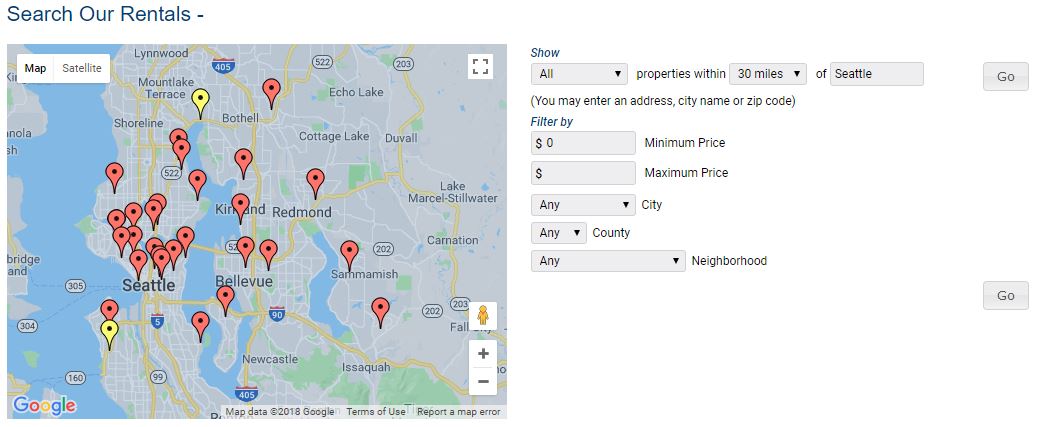

Cast a wide net the first time you look at rentals to get an idea of the market & availability. Housing search engines like Craigslist or Zillow are good places to start, but there are also dozens of other places to look too: National rental websites to aid your next apartment hunt.

-

Your timing.

There is a best time to look at the market.

Do a ‘practice search’ a month before you’re ready, to get an idea of the timing of the market. For instance, if you want to move in September 1, begin watching the rental websites around June 20, and observe thru July 10, to see what comes on as available for August 1, and see how fast it gets rented. Then, start your real search about July 20, and know that if you haven’t secured a place by about the 5th of August, the selection will quickly be diminishing.

There may be some good deals that pop up at the last minute (in the above example, ‘last minute’ would be after August 10) by landlords with an unexpected vacancy and hoping to avoid a vacant month (and therefore pricing a bit under market), but- this is only a viable search option if you have flexibility on your move-in date / month. If you’re totally flexible on dates, searching this last-minute market for deals can be rewarding, but it’ll often take a few months to come across a deal on a place you really want to live.

-

Your Search.

CraigsList is a great source of available properties, but beware who is on the other end of the ad. If it’s not a reputable firm that is listing the rental, take appropriate precautions to both ensure it’s not a scam, and to ensure that a private-party landlord is aware of and adhering to landlord/tenant law. NEVER send a deposit to ‘hold’ a place without establishing for sure the legitimacy of the listing. More and more, even reputable firms and actual listings are being impersonated online, with only the contact info being changed. Contact companies, and their agents, through the contact info on their corporate website to ensure you’re really reaching who you think you are.

-

Your Application.

When you do find the perfect place, be ready. Chances are, it will appear perfect to you for the same reasons that lots of others will find it attractive, so… expect competition to rent it. Being ready means having all of the information available to complete a rental application, and having proof of income, and ideally having written letters of recommendation from previous landlords, available to submit with the application. Depending on the property and the market, you MAY want to offer the landlord a bit over their asking price to stand out from a large group of applications. This works the same as in the Property Sales world.

What to Consider When You’re Considering a Micro-Unit

Considering a Micro-Unit?

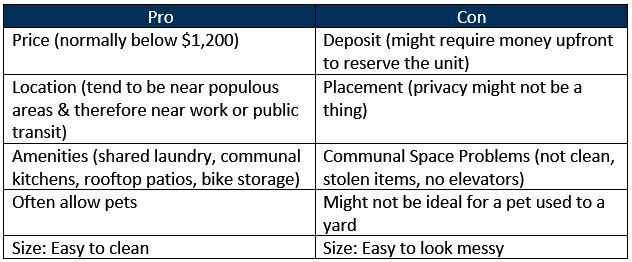

The price of a micro-unit will definitely peak your interest. But, is it a good fit for you? It’s important to consider the pros and cons before you make the move to a micro-unit since they come with a specific set of unique attributes. Let’s dive into the pros and cons and see if you could manage:

Pro’s & Con’s:

Questions to as yourself:

- Can you live in such a small space?

-

- What things do you have that would fit and what would you have to get rid of?

- Are you ready to live a minimalistic lifestyle?

- Can you park nearby, or can you bus/bike to work and everywhere else you need to go?

- Think: the grocery store, gym, volunteer positions, etc.

- Can you invite friends over and have everyone be comfortable?

- Will your pet be able to handle being cooped up while you’re at work?

- How often can you let your pet out?

- If the amenities are great, how often do you think you will use them?

- Rooftop patio: That’s great, but is there a dog run? What about some shelter from the rain? What about patio furniture?

- Bike storage: Do you own a bike or are you planning on purchasing one, now that parking is limited or nonexistent?

- Communal kitchen/hang out space: Do you lean on the extrovert side? Are you willing to share the space when you need a change of scenery? Or, are you okay with not using the space?

It’s up to you to decide what you can live with or without. It’s important to come up with your own priorities and answer them for every unit you look at, not just micro-units.

The next step is to see a few places. It’s hard to really imagine what you can do with the space until you’re in it. When you’re viewing the units, have a list of questions prepared to ask the leasing agent. Some of these will be answered by the leasing agent without you even having to ask, others you will need to be upfront about.

Questions to ask the Leasing Agent:

- What kitchen supplies does it have/can I bring in?

- Sometimes they will have a hotplate for you, other times you might only have a microwave.

- Is there extra storage anywhere in the building?

- Are there options like a lofted bed? Are there any units that have a different layout or in-unit laundry?

- Are different units priced differently? If so, why?

- Who would be on-site? How do I submit repair requests?

- How do I pay:

- Rent?

- Damage deposit?

- When are these things due?

- What are their requirements?

- Credit score?

- Rent to income ratio? (they often have Multifamily Tax Exemption or MFTE or 2x the rent)

- Accept cosigners?

- How do you apply?

Think you could do it? What are some of the things you’re willing to sacrifice living in less than 400 sq. ft? Tell us in the comments section!

Need a Good Vendor: A Guide

Need a good handyman or Sub-contractor?

Use these questions to start your interview with a potential vendor. They will help you protect your investment property, both structurally and financially.

Having a vendor list you can trust is crucial for maintaining your investment property while staying within your budget. If you know they’re going to get it done right, sometimes it’s worth the extra $50-$100 at the beginning, rather than the expensive 2nd fix that may be required if you use a disreputable vendor.

Sites like HomeAdvisor help connect property owners with contractors and subcontractors who can pretty much do any job! From painting to plumbing to electrical to hot water, it’s a great resource for people who don’t have a verified vendor list.

Another option is Keepe, an app that works like the Uber for handymen. It connects you to a handyman who can do the job. Using photos you send, they can estimate the costs of labor and materials, and then they schedule with your tenant.

If you’re looking for someone directly though, how do you verify that they’re the real deal? Here are some tips on how to vet your vendor:

Are they licensed, insured, and (for larger jobs) bonded?

Always ask to see proof of their license and insurance. This is a critical step, and anyone who is a decent contractor for any type of job will understand and willingly provide you with these documents. They will also likely have them handy or have someone in their office send you a copy.

What are the payment terms?

Do they require an upfront deposit?

If they estimate that the job is going to be $100 or $200 but still need funds up front, that’s a red flag. For larger jobs, asking for ½ of the bid or estimated price up front for materials is normal. It’s not ever normal to pre-pay the entire projected cost.

Time & Materials vs Firm Bid

Is their estimate based on how long it will take them and what the materials will likely cost, or do they have a firm bid? Most likely a firm bid will come out to be more expensive because the contractor has to accept the risk of having estimated the job wrong, so… the risk is a factor in their bid price. If you agree to pay for time & materials, the contractor has no risk, as they’ll be paid for whatever the job costs them so no risk buffer needs to be built into the price. That said- they also lose some incentive to work as efficiently, and the owner then has the risk of the estimate having been too low.

Net 30

You’re waiting for the tenants to pay rent next month so you can pay this vendor – make sure ahead of time that they’re willing to extend 15 or 30 days time for payment. Many small contractors operate on a thin margin and have to pay their labor weekly or bi-weekly. Making them finance the job doesn’t usually make sense for anyone.

Who recommended them to you?

The internet

What do other people say about them? Do they have a good rating? What do 1-star ratings say about them and when were they posted? Remember that people only review when they’re either ecstatically happy or severely disappointed.

A friend

Ask what kind of job they did. Hopefully your friend has before and after pics. Or they might have a good story about them that will help you understand who they are and how they work. It’s important to be able to trust the person in your home, even if it’s not your stuff in that house.

It’s also a good idea to be able to trust that vendor with the tenants: It’s never fun trying to calm the tenants down if the vendor prematurely tells them something like they might have asbestos or lead or mold in their home.

Selecting the Right Property Manager

Looking for a Property Manager to manage your investment property? Here are some tips:

Carefully selecting the right property manager is one of (if not) THE most important step(s) of owning investment properties. Having the right property manager will impact profitability, risk, and enjoyment of the venture like few other decisions an owner will make. This is true even for owners that decide to self-manage: they’re still selecting a property manager (themselves) and should still evaluate that choice as though they are one of the agents competing for the job of property manager.

The job of property manager varies somewhat depending on the type of property being managed (so of course one consideration is a Property Manager’s experience with a particular type of property), but there are some considerations that apply to selecting a Property Manager for all rental types. Below are some elements to consider, with thoughts on each. They’re in no particular order, and I believe they should all play a role in making the correct choice.

Experience

As in all professions, there is a learning curve. A primary reason for hiring a professional is to not start at the beginning of that curve. There are perhaps 100 issues that routinely arise in the course of managing property and choosing an agent that has been around to have seen, and learned how to respond to, the majority of them will pay dividends. That said, I wouldn’t necessarily automatically rule out a newer agent (with off-setting strengths), but I would then more carefully assess the team and support such an agent would have to rely on.

Stability

Another key reason people hire managers is the convenience of having someone else track all of the details involved in managing property. If an agent doesn’t stick around, that loss of continuity usually results in details (sometimes important ones) being dropped and an owner’s time being wasted. Therefore, I’d suggest looking for signs that the agent (and company) you choose is likely to still be in the business 5 to 10 years down the road.

Integrity

Finding an agent who will reliably give honest answers, even when it’s not in their immediate self-interest, is crucial. Sometimes the answer to an owner’s question isn’t one they want to hear. [i.e.: “How much can I rent this property for?” Too often, the Agent that answers this question with the highest number is simply not telling the truth.] Use an agent who is candid and follows through with their word.

Capacity

One agent can only handle so many properties well. That number varies depending on the type of properties, type of leases, and management structures they employ, and on the particular agent; but there’s always still a number at which an agent is maxed out, and over which the quality of the service they’re providing will diminish. So, while experience matters (a lot), picking an agent that’s going to be too busy to adequately focus on your property isn’t good either. Ask ‘How many accounts they manage?’, ‘How many they managed two years ago?’, ‘How many more they would take on before considering their portfolio to be full?’.

Personality

The job of property manager isn’t that of a salesman, nor of an attorney, nor accountant, nor economist, nor psychologist… but it has elements of all those professions. A good manager has skills in all these areas so that disputes are avoided. Then, when disputes inevitably arise anyway, they’re excellent at disputed resolution. Look for someone who is not volatile but is good at thinking long-term and is results oriented; someone that sees the value of having all parties go away satisfied rather than one that will engage in and try to ‘win’ every argument.

Likability

As you’re looking for stability, look for someone that you will enjoy working with over the course of years. Some personalities just don’t mesh, regardless of all the other factors. Recognizing and respecting when that’s the case will make life easier.

Organization

Artists don’t necessarily need to be organized. Property managers necessarily do. Look for signs. Do they have systems in place to ensure that all details are always covered? Do they show up on time and well prepared?

Communication

A property manager is going to be speaking (and writing) for you. Their communication is therefore a reflection of you, and the devil is in the details. In most cases, you’ll be giving your property manager a limited power of attorney to execute written agreements for you. Make sure they can communicate carefully and accurately. Well-written agreements (and clearly enunciated conversations) will greatly minimize future disputes.

Price

Like all services you buy, price is a consideration, so that’s not a point I need to make here. My point on price is: I see a lot of people comparing the price of property managers without comparing the other attributes those property managers have. They don’t do this with properties, they don’t do it with cars, or clothes, but… they often tend to assume property management is a commodity.

What most investors care about is profitability. Profitability is primarily impacted by minimizing vacancy and litigation while maximizing rental rates through proper maintenance and marketing. So, while the fees paid to a property manager are on the balance sheet too, keep in mind the other balance sheet factors that a property manager influences. They’re much more impactful on the overall profitability of an investment.

Compensation structure

I’d look for structures that align an owner’s interest with the property manager’s.

Comprehensiveness

A long property management agreement isn’t an enjoyable read for owners any more than a long lease is for tenants. But a stitch in time saves nine. By taking the time to properly address all the pertinent issues covered in these long documents, a good property manager is diligently communicating so that future conflicts are avoided. Beware a 1- or 2-page agreement that leaves unknowns out there. If that’s the level of attention being paid to details… that’s not good.

Tools

Technology is rapidly advancing. Look for an agent that is incorporating new tools to maximize benefits for their clients.

Accounting and Administrative Support

Consider the level of support their team will be providing and the type of software they’ve invested in. What kind of access will you have to conveniently track your portfolio and that your tenants will have to pay rent.

Reputation

Choosing a firm with a good local presence associates your property with that reputation. When potential renters see a reputable brand, they infer that their relationship with such a landlord will be transacted in accordance with the business standards associated with that brand. Many will find value in that level of comfort, and such considerations will help your property achieve its highest market value.

Meet in person with your potential Property Manager to get a feel for the way they work and how you will work together. If you’re interested in talking with our agents, check out our team and give us a call!

Service Animals in Rentals

Is it a pet or service animal? There’s a difference!

Service animals and Emotional Support Animals (ESAs) are not pets. Tenants who have them are protected by HUD laws. Much like you wouldn’t ask someone what their prescription is for, you can’t ask the tenant what they suffer from that requires an animal. Here’s how to handle service animals versus pets:

1. Service animals don’t need to be certified.

But there should be some other form of proof like a note from a doctor. However, if the disability is obvious then that’s all the proof you need; i.e. If they are blind and have a seeing eye dog, this shouldn’t even be a conversation. However, if the disability isn’t obvious you may ask for documentation.

If they don’t have verification of the animal’s status, then it is considered a pet, and you can charge a pet deposit and pet rent. But with a note or certification you cannot charge anything for the animal

2. Service animals come in all shapes and sizes.

You might have heard about the United Airlines scandal when they didn’t let a Service Peacock on the plane – That was a violation of the ADA laws. Keep this in mind when someone says their snake is a service animal. Also, keep it in mind when they say their Pit Bull is a service animal. You cannot judge for yourself whether an animal is or isn’t qualified, but you must instead rely upon the documentation.

What you can do:

We suggest asking for the proof in a professional manner. Something along the lines of “Please include the certification of your service animal or ESA with your application.”

Now, this begs the question: what if their animal causes damage at the rental property or a nuisance?

The answer: you may hold the tenant liable per the terms of their lease. Use the tenant’s security deposit to fix any damage to the unit as you would with any other tenant.

Always work according to your local and state laws regarding discrimination. We are a firm based in King & Snohomish Counties of Washington State and are constantly watching the pertinent laws in our market to better understand how to work with people with disabilities, and how to keep landlords in compliance.

Rent Prices Have Failed to Keep Up with Surging Property Values

Rental prices are not keeping up with home sale values.

Taking into consideration the current market and recent property tax increases in our area, it’s not hard to see that these two linked industries depend on each other more than people tend to realize.

When Landlords sell, they will sell at a market price. This has two potential consequences:

- If the buyer doesn’t rent, it reduces the supply of rental housing, thus increasing the rental price for other rentals.

- If the buyer rents the home out, they will have to base the rent on higher ownership costs, again resulting in a rent increase.

Since this data is changing daily, let’s look rental prices and home prices from reports in 2017.

The Seattle Times wrote an article on 12/5/17 entitled “Rent Control in Seattle? Bill to Repeal Statewide Ban in the Works.” From this article: “Rents have soared 65 percent since 2010 in Seattle — with the average two-bedroom now topping $2,000 a month.”

Whereas “Seattle’s Median Home price Hits Record: $700,000, double five years ago” (Seattle Times headline 4/6/17). Or, according to Zillow, Seattle’s Median home value has gone up 97% from Dec. 2010 to Dec. 2017.

We see it all the time. Rental Prices are going up, tenants are struggling to find affordable housing, and people are struggling to buy their first homes.

To put this all into context, that increase in rental prices is 65% over 7 years, but home values have increased 97% in that same timeline.

So instead of ‘Rents have soared’, the more accurate message is: ‘Rents have failed to keep pace with surging property values and ownership costs’.

As we continue working in this industry, it’s important to remember that a sales and rentals coincide. When property investors buy or sell their investments, those prices ripple into the rental industry as prices go up for both the homeowner and the tenant.

Spring Cleaning for your Rental Property

Proactive spring cleaning for your rental property: A quick guide to a spring inspection of your property investment.

It’s time to clean out your home for spring. The sun is out later in the evening, and we’re able to assess the damage of winter. But don’t forget about your rental property, because your tenants might not be taking the appropriate preventative measures to keep the house and property in tip-top shape for this renewal season.

Give your tenants 2 days’ notice, and inspect the property, don’t forget these three things to look for.

Filters, Vents & Drains, oh my!

Filters:

Unless you know what you’re doing, send out an HVAC company to check on the furnace filters and ventilation systems in your house. It’s an important step to reduce dust and build up and prevent fires. Don’t forget your AC units, make sure to change the filter & spray the outside of the condenser with a hose (not a pressure washer).

Vents:

Put a piece of toilet paper to all your fans and vents to make sure they’re working properly.

Drains:

While you’re at it, inspect your washer and dryers and sinks and all things that drain.

Check the walls and floors for signs of leakage or build up in the utility room or wherever you store the washer/dryer.

Run the water in sinks and tubs/showers for 30 seconds to a full minute, make sure they’re draining properly. Check your dishwasher drain and make sure it’s free of debris.

Oh my:

If you don’t watch these things, you could be saying “Oh my!” when you have to send someone out there to fix a clog and it sets you back $200+.

Clean up the garden.

Look Down:

Make a day of it with your green thumb, or send a professional out to clear the debris, refresh the top soil, rake the lingering leaves, and tear up those weeds and dead plants that aren’t coming back. Scrub the moss away from your patio and driveway, that will be a slip hazard in the rain.

Look Up:

Don’t forget the gutters! Clogged gutters will cause water to seep into your basement, especially if you have any windows below the ground level.

Getting help:

The earlier the better, you’ll want to get that grass growing ASAP with the rains that are still in store soon, but also because landscapers tend to fill up fast!

Landscapers pricing will depend on the size of the yard/garden area and the amount of work it needs.

Inspect for mold that your tenants might not notice.

Check your crawl space that the plastic sheet is still covering the dirt and that there aren’t any leaks or wet marks. If your pipes freeze, examine those while you’re at it.

Take a look at the window sills and tracks for any sign of mold – this is usually a tenant responsibility to clean but check your lease before asking them to tend to it.

Open and smell the washer – have the tenants run a cleaning cycle with a little bleach to get rid of any mildew smell.

Make sure to peak under the sinks and around toilets and faucets to leaking pipes, new and serious water damage. Water damage under the sink is normal wear and tear, but anything more severe could point to a larger problem that needs to be addressed.

What else do you look for when you annually inspect your investment? Do you have any other spring cleaning tips? Let us know in the comments section!

Three Rookie Mistakes to Avoid

Don’t make these rookie mistakes! Avoid a sticky situation with your tenants by following these three rules to property management. Make sure you are following the laws of your location, renting your house out isn’t easy, but don’t make it harder on yourself than it needs to be.

Rookie Mistake: Not making tenants formally apply.

The application process is an important step when determining if tenants are right for your investment home.

The resu lts provide a legal basis for accepting or rejecting applicants while mitigating the landlord’s risks of an unlawful discrimination claim. Keep in mind though, there are a considerable number of laws that regulate what can and can’t be considered, and they vary from one jurisdiction to the next. For instance, it’s a violation of Seattle City Statute to even screen an applicant’s criminal history, whereas that’s normally considered a vital part of the screening in all other local jurisdictions.

lts provide a legal basis for accepting or rejecting applicants while mitigating the landlord’s risks of an unlawful discrimination claim. Keep in mind though, there are a considerable number of laws that regulate what can and can’t be considered, and they vary from one jurisdiction to the next. For instance, it’s a violation of Seattle City Statute to even screen an applicant’s criminal history, whereas that’s normally considered a vital part of the screening in all other local jurisdictions.

Also, know what your minimum standards are and why. If you think the tenant needs to have a 750 credit score, know why you think that – is this a luxury home? Is that credit score indicative of how they will treat the home, or is it arbitrary? Keeping standards high can help, but keeping them too high can result in unnecessary vacancy. Will someone with a 690 treat the home the same? Did they really need to have this same job for 3 years? Or will someone who just moved here treat the house with the same respect?

In some local jurisdictions, these criteria must all be published with your advertisement for rent.

Rookie Mistake: Not having a written lease.

You might think that because ‘they seem like good people’, or because you want them on a month to month basis, that you don’t need to have a written lease or rental agreement. Just wait until you do your annual inspection and find that they have unauthorized pets who have brought fleas and mice into the home. Without written terms, you’ll have a hard (often impossible) time holding the tenants financially responsible. Having a written lease won’t solve all problems, but it’s a huge first step.

Also, as laws vary so widely, stay away from generic lease forms. Use a lease from your local landlord’s association, or have an attorney draft one for you. You want to protect yourself and your investment as best as you can, and having a written agreement is a fundamental aspect to that business relationship between landlord and tenant. You can fall back on it for those difficult conversations, like how they should pay a pet deposit and that they’re responsible for that infestation.

Rookie Mistake: Not properly recording the condition of the property when the tenants move in.

This is critical in order to determine what damage was done by the tenant that exceeds normal wear and tear. Photos are your best friend in court, to accompany a written report of how the place looked on the day of move in. Don’t forget that dent in the western wall of the living room or all those specific light bulbs that were working in the bathroom – these are items that should be documented so when the time comes to move out, you have proof of what is their responsibility and what is yours.

Don’t forget to record the utility meter readings, and to ensure that the tenants properly transfer appropriate utility accounts into their name.

Avoid these common mistakes to get yourself out of future implications, save money and time, and get the most out of your investment property.

Timing the Rental Market

Knowing when to market your property is half the battle.

Profitably managing a rental property depends in large part on timing. First off – a landlord’s potentially largest variable expense is vacancy. I say ‘potential’ because the goal is to therefore have a vacancy rate approach zero. This is achievable by pricing a property correctly and understanding both the monthly and yearly rental cycles.

First, monthly:

In the Seattle market, tenants that are leaving a month-to-month rental are required to give notice to their landlord around the 10th of a month. Few want to do that without already having secured new housing. This means there is a predictable drop-off of leasing activity each month around the 10th.

For instance, if a property were to be available July 1st, tenants wanting that move-in date will start looking around May 20th. They will be making most of their offers between May 25th and June 5th. Activity will quickly die down after June 10th. Landlord’s should therefore try and have their property listed on the market, in as many places as possible, by May 15th (asking the upper-end of the realistic rental rate initially), and they should adjust price based on results to find the market by June 10th at the latest.

Annually:

As a rule of thumb, whatever the correct monthly rental rate for a property is in November, December, or January, it’s going to be about 10% higher in June, July, and August. September 1st is normally the busiest move-in date of the year. But then the market dramatically slows in the fall. If you priced too high in May and didn’t get it rented, the market may come up to that price in June. But if you priced too high in September, you might benefit from dropping the price quickly to get ahead of the downward curve that’s coming during the fall months.

Further – schedule leases to end in May, June, or July (regardless of whether that means a 6, 9, or, 18-month initial term to get on a summer rental cycle). Also, avoid month-to-month rentals as the landlord then loses control of what cycle their property will be on.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link